Uganda's first children-centred insurance product launched

)

- Unveiling of Uganda’s first-ever children-centered medical insurance product, J-Junior Medical Cover

- Aiming to decrease the financial burden of healthcare for children aged 0-17 years

- Highlighting the critical need for expanding medical insurance coverage in Uganda, especially for children

A new health insurance product geared at enhancing healthcare accessibility for the younger demographic has hit the market.

Uganda’s first-ever children-centred medical insurance product, the J-Junior Medical Cover was unveiled on Tuesday, July 16 in Kampala.

Spearheaded by Jubilee Health Insurance, this pioneering initiative aims to substantially decrease the financial burden of healthcare on families, specifically targeting children aged 0-17 years.

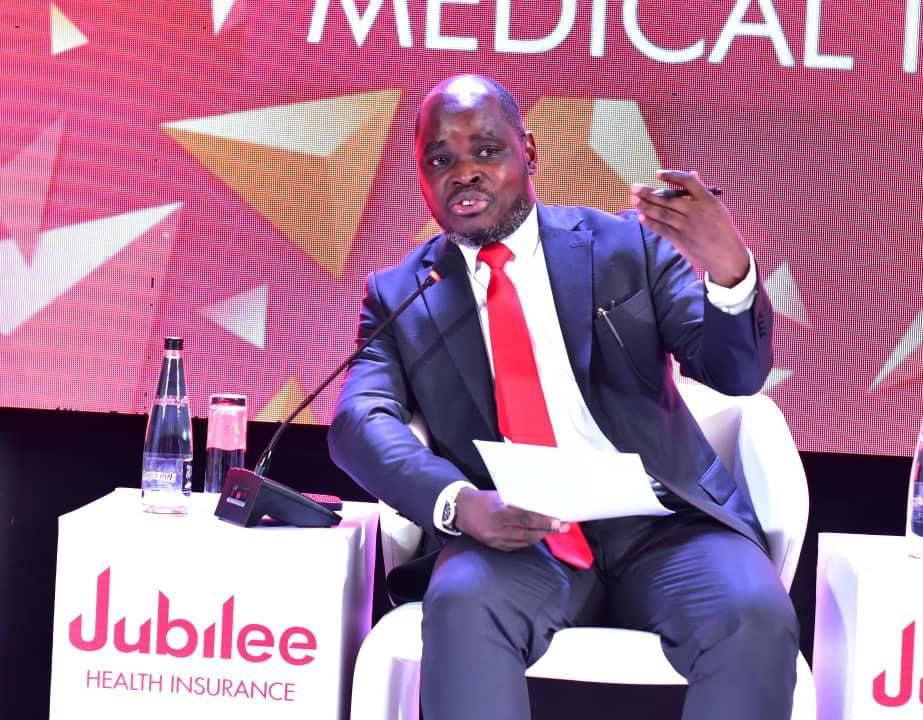

At the launch, Dan Musiime, CEO of Jubilee Health Insurance highlighted the critical need for expanding medical insurance coverage in Uganda, especially for children who constitute a significant portion of the private health insurance sector, yet remain underserved.

Currently, only 400,000 Ugandans are enrolled in private health insurance plans, of which about half are children.

This new product emerges against a backdrop of increasing healthcare costs and the alarming statistic from the World Bank’s 23rd Uganda Economic Update Report, which indicates that out-of-pocket health expenses annually push one million Ugandans into poverty.

“Research shows some serious gaps in the healthcare sector in Uganda. The infant mortality rates can be avoided with the right intervention. Our product was designed to address these gaps in the market by providing comprehensive medical insurance that is also affordable,” Musiime said.

The J-Junior Medical Cover he said, is designed to address these challenges by providing comprehensive health coverage that includes pre-existing conditions, chronic illnesses, psychiatric care, and more.

One of the unique aspects of the J-Junior Medical Cover is its appeal to Ugandan parents working abroad.

Dr Maurice Ego, Head of Claims at Jubilee Health Insurance, emphasized the product's benefit to diaspora families who often face challenges in managing healthcare for their children back home.

This policy ensures that their children’s medical needs are promptly and effectively addressed without the logistical and financial hassles of international money transfers.

The insurance policy offers various levels of cover, ensuring that it caters to different healthcare needs and budgets. It includes benefits like access to a nationwide network of healthcare providers, coverage for treatment outside Uganda, and support for post-hospitalization recovery. Additionally, it encompasses a funeral expenses benefit, providing financial support during the most challenging times.

Dr Dan Tumwiine from the Children’s Clinic Nalya noted during the launch there are about 25 million patient visits a year in Uganda, and 2 million in Greater Kampala Wakiso and Mukono.

From his experience, Tumwine says the demand for private medical insurance is on the rise mostly among business owners and entrepreneurs.

Jubilee Health Insurance has facilitated the purchase of J-Junior policy through multiple channels, including their website, partner banks such as DTB, KCB, Ecobank, Absa, DFCU, and I&M, and through licensed agents and brokers. This accessibility further underscores the company's commitment to making healthcare affordable and reachable to every child in Uganda.

)

)

)

)

![The case Zuena has against Luwi Light [DOCUMENT]](https://sportal365images.com/process/smp-images-production/pulse.ug/02022026/234d4a4f-77bd-4612-9ed7-c9ae5b18df4c.jpeg?operations=autocrop(112:112))

)

)