Dig deeper to stochastic oscillator strategy

)

The right timing to enter and exit a position is crucial to profiting from the asset's price differential. These are the start and the end, but they're the areas that you need to be meticulous about.

This is where the Stochastic Oscillator strategy comes in handy. This momentum indicator helps you find those key market moments to buy and sell assets. It does this by comparing the asset price from its historical data to determine whether it's too expensive (overbought) or too cheap (oversold). It's like having a magical scale that tells you if the asset is a buy, a sell, or just ignore.

This article will walk you through everything about the powerful stochastic oscillator strategy. This covers the concept of overbought and oversold, how to calculate it, and how this strategy works for scalping, day, intraday, and swing trading.

Why Should You Have a Trading Strategy?

A trading strategy is crucial to ensure that all you’re entering the market systematically, consistently, and safely. It provides you with valuable references about the financial markets, including:

- How the market will move

- In which direction it will move

- How long the trend will last

- How much risk your position will be exposed to

Ultimately, having a sound strategy keeps you off of trading emotionally because you follow a systematic approach on each trade. Moreover, it would allow you to profit amidst the complexity of online trading—even if you’re just starting out.

Numerous online resources introduce and guide you through different trading strategies. While some can be complex and overwhelming to understand, they are ultimately helpful.

If you're a beginner looking for a friendlier approach to learning online trading, you should visit Traders United. TRU is an organization of traders that publishes free educational resources designed to empower online traders to make informed and better trading decisions.

What Is a Stochastic Oscillator and How Does It Work?

The stochastic oscillator is a momentum indicator that tells you whether the current market trend is strong, weak, or neither. It essentially analyzes the asset price momentum over a specific period, compares the asset price to the previous period, and suggests whether the asset is overbought or oversold.

This trading strategy can be used for multiple time frame analysis, but when we backtested it, we found that it works best for a 15-minute time frame.

But what does this indicator tell you? Well, it shows the condition of the asset—whether it's too expensive (a buy signal) or too cheap (a sell signal). Remember, these market conditions are integral in spotting trends, as they suggest market reversal and retracement.

When used correctly, this strategy is valuable for spotting optimal market points to enter or exit a trade.

What is an overbought?

In technical analysis, an overbought condition indicates that a certain market is experiencing significant buying pressure.

Note: By market, we’re talking about the currency pairs, stocks, cryptocurrencies, or other financial markets.

In other words, an overbought suggests a skyrocketing upward asset momentum due to the influx of buyers in the market. This makes the closing price too cheap compared to the range's lowest low and highest high.

With a stochastic oscillator as an indicator, you have a reference for an asset's condition value. An asset with an 80 or above stochastic value indicates an overbought condition. This shows that the price may have risen too far, too fast, and a reversal to the downside is possible.

What is an oversold?

The oversold market condition indicates significant selling pressure that an asset is experiencing. This means that the price is at lower fundamental point where it is usually at.

This happens when sellers outnumber and outpower buyers, which makes the market aggressively downward and may signal a potential drastic drop. But what makes traders react this way? It’s often due to the prevailing negative sentiment towards the asset, which is due to bad earnings report, company problems, or other fundamental factors.

Using a stochastic oscillator strategy is proven as a useful tool to identify gauge if the market is currently oversold or not. Simply look at the indicator value. If it shows below 20, then you can assume that the asset is currently oversold, which mean that the asset is falling excessively. Oftentimes, but not necessarily, an oversold market may also reserve upward due to intervention of institutional traders and whales holding those positions.

Caution: Stochastic oscillators tend to throw false signals

Financial markets, like forex and stocks, are infamous for being dynamic. It changes and even fluctuates from time to time, happening randomly. Thus, any technical indicator is susceptible to drawing out a false overbought or oversold region.

Always use stochastic oscillator indicators in conjunction with other technical indicators to improve the accuracy of the signal. Remember, two (or even more!) is always better than one.

Here are some indicators we found to work best with stochastic oscillators:

- Support and Resistance

- Moving Average Crossover

- Moving Average Convergence Divergence (MACD)

- Relative Strength Index (RSI)

If you can notice, all these indicators tell you the momentum of the asset price. Using these together with a stochastic oscillator can solidify the signal you just analyzed.

Calculating Stochastic Oscillator Indicator

%K = 100(C – Ln) / (Hn – Ln)

That’s the formula to calculate the stochastic oscillator value. While most trading platforms automatically gives out the value of stochastic oscillator, knowing how to calculate it would help you personalize this strategy and customize it accordingly.

You need to have the following data to calculate the stochastic oscillator value of a certain market on a specific period:

- %K = Stochastic Indicator value

- Hn = Highest high of a specific period

- Ln = Lowest low of a specific period

- C = Current closing price

The central concept of a stochastic oscillator is comparing the asset's current closing price to its range over the specific, predetermined market period, which includes the highest high and lowest low.

In this way, investors using stochastic oscillators have an indicator that foreshadows market reversals.

Picking the Right Stochastic Oscillator Settings

Setting up the right settings for stochastic oscillators is essential to manage the amount of market noise you want to include in your data.

Remember, the wider the time frame of the setting, the more market noise is present in your analysis. The more saturated your data is with market noise, the harder it is for you to find the prevailing market trends. That's why if you're just starting out, it is crucial to start with a time frame that's just in between—not too narrow but not too wide.

That's why, for stochastic oscillator trading, we found it best to use 15 minutes to easily spot the overbought and oversold signals.

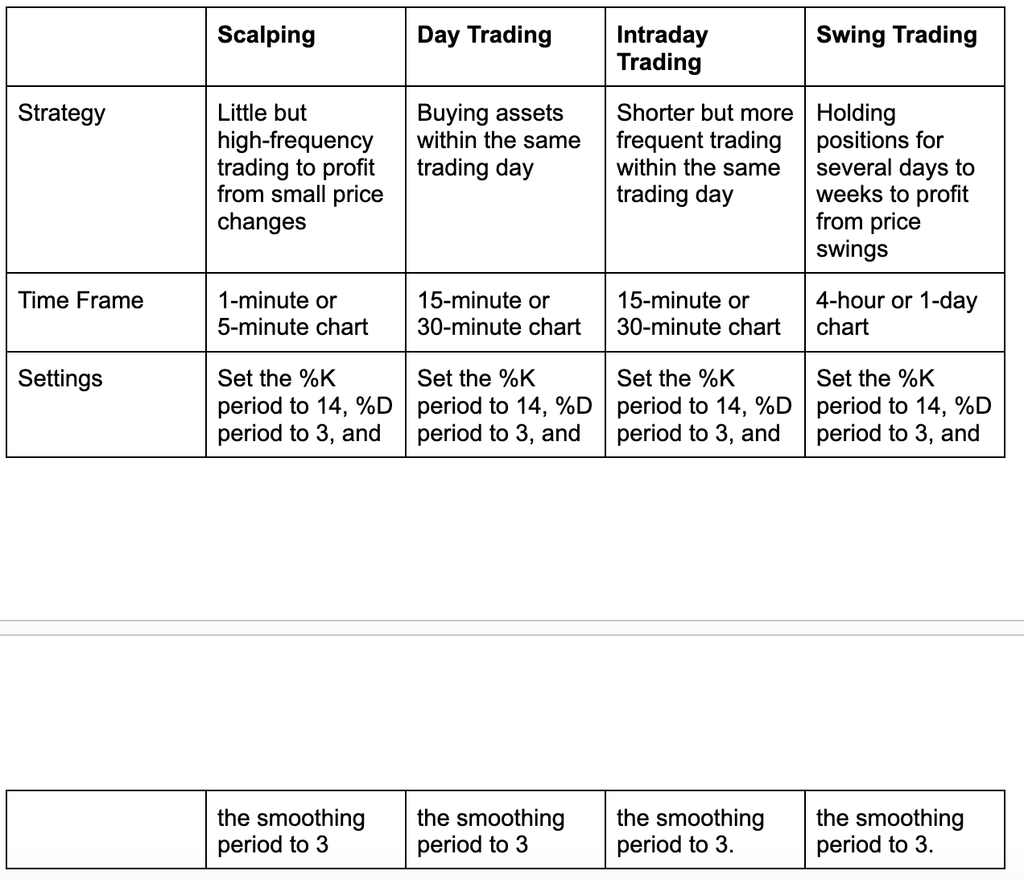

Stochastic Oscillator Strategy for Scalping, Day, Intraday, and Swing Trading

This strategy caters to short—and medium-term strategies because it allows you to monitor the price momentum of an asset up to a 14-day or 2-week market period.

Specifically, this strategy can be applied to scalping, day trading, intraday trading, and swing trading.

Why You Should Use a Stochastic Oscillator?

Simplified decisions

The stochastic oscillator gives actionable and often reliable signals on whether to buy, sell, or do nothing about the prevailing trend.

When this momentum indicator shows a value above 80, it suggests that the asset is experiencing an overbought condition. This condition indicates a good and profitable moment to sell assets.

On the other hand, a stochastic oscillator value of below 20 represents an oversold market condition. During this period, it's profitable to buy an asset because the market tends to reverse upward.

But remember, any technical indicator has a tendency to provide a false signal. Always use a combination of other momentum indicators to confirm the market trend and condition suggested by the stochastic oscillator.

Versatility

This price momentum indicator can be used to analyze different financial markets, including assets of currency pairs, stocks, and cryptocurrencies.

Moreover, it's applicable for multiple time frames, up to a three-week period. However, upon backtesting this strategy, our trading experts found that this momentum indicator works best for 15-minute time frames.

Whether you are trading forex, stocks, or cryptocurrencies, the stochastic oscillator can be applied to all these markets. It adapts to different time frames, making it useful for intraday trading, scalping, and swing trading.

Enhanced accuracy

Analyzing asset price momentum using the stochastic oscillator indicator would provide a more precise and better perspective of what's happening on the market.

Thus, trading with a stochastic indicator allows you to make better decisions about when to enter or exit a trade, promoting profitability and risk mitigation.

Reduced frustration

Instead of baselessly placing long or short positions, the stochastic oscillator strategy offers a more sustainable and systematic approach, reducing frustration and fear while trading.

Wrapping Up: Should You Use Stochastic Oscillator Strategy?

While no tool can guarantee success, the Stochastic Oscillator significantly enhances your ability to time the market, making your trading journey smoother and potentially more profitable.

#Featuredpost

)

)

)

)

)

)