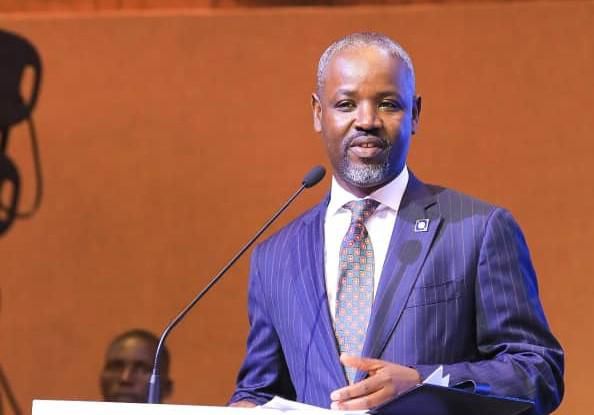

Police investigate Mangu Cash threatening call to Speaker Thomas Tayebwa

)

Assistant Inspector General of Police (AIGP) Tom Magambo confirmed this Thursday morning that investigations are underway into alleged criminal conduct by online lender Mangu Cash.

Responding to Tayebwa’s social media post on Thursday, AIGP Magambo said, “Rt Hon. This concern is well received. My colleagues and I will do our best to handle this and other related crimes.”

Tayebwa had earlier taken to X (formerly Twitter) to recount a threatening call from a woman claiming to represent Mangu Cash.

The caller allegedly demanded Tayebwa produce someone who had listed him as a next of kin when securing a loan, failing which the lender would deduct money directly from him.

The Deputy Speaker described the incident as criminal and called for tighter regulation of the online lending sector.

“I think a lot of criminality is going on. I hope our telecoms do not allow their mobile money platforms to be used to carry out fraud orchestrated by such unscrupulous companies,” Tayebwa wrote.

Growing Challenges in Uganda’s Digital Lending Sector

This incident sheds light on the broader challenges posed by the rapid rise of online lending platforms in Uganda.

While these services provide quick access to credit, many operate in a legal grey area, employing unethical practices such as harassment, data misuse, and exorbitant interest rates.

According to the Uganda Microfinance Regulatory Authority (UMRA), consumer protection has been undermined by the lack of stringent oversight, leaving borrowers vulnerable to exploitation.

A 2021 report revealed that 96% of SMEs lacked insurance coverage, and similar trends reflect limited consumer education on the risks associated with unregulated digital lending.

Efforts to curb these practices have intensified, with UMRA drafting new guidelines in 2023 to address predatory lending and safeguard borrowers.

President Museveni’s Stand on Exploitative Money Lenders

President Yoweri Museveni has also raised concerns about exploitative lenders.

In September 2024, Museveni criticised those charging exorbitant interest rates, labelling them "criminals" and vowing to crush their operations.

He directed the Ministry of Finance to fast-track regulations that would protect borrowers from unscrupulous lenders.

Museveni emphasised that unchecked lending practices hinder economic growth and frustrate entrepreneurs.

Path Forward for Regulation and Consumer Protection

The government’s Digital Transformation Roadmap 2023–2028 aims to address such gaps by improving financial literacy, consumer protections, and regulatory oversight.

As the investigation unfolds, consumers are urged to remain vigilant when engaging with online lenders and to report any fraudulent or unethical practices to authorities.

)

)

)

)

)

)

)